Consignment Accounting

Consigned inventory is a flexible inventory management approach suited for businesses looking to minimize risks and optimize cash flow. Xledger’s financial automation software helps companies effectively manage their consigned inventory with a high degree of efficiency and insight. The consignor is taking on quite a bit of risk by being able to take on the majority of the product’s stock from the warehouse. This is due to the possibility that shops will only effectively sell the goods.

What is consignment inventory and how does it work?

For the consignee, proper accounting ensures that consigned goods aren’t mixed with other goods. For the consignor, it helps them account for the cost of goods sold and revenue. Therefore, there are two parties in a consignment inventory deal, the consignor and the consignee. The accounting treatment for consignment inventory depends on whether the consignee sells the goods or not. The consignee also has the option to return any unsold or damaged goods to the consigner.

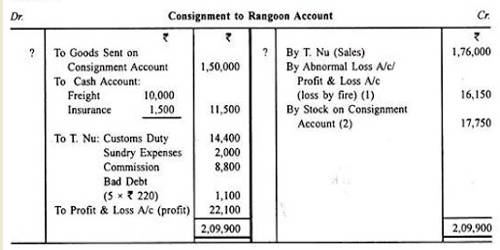

Journal Entries for Consignment Inventory

Unlike IAS 2, in our experience with the retail inventory method under US GAAP, markdowns are recorded as a direct reduction of the carrying amount of inventory and are permanent. There is no requirement to periodically adjust the retail inventory carrying amount to the amount determined under a cost formula. Inventories are generally measured at the lower of cost and net realizable value (NRV)3. Cost includes not only the purchase cost but also the conversion and other costs to bring the inventory to its present location and condition. If items of inventory are not interchangeable or comprise goods or services for specific projects, then cost is determined on an individual item basis. Conversely, when there are many interchangeable items, cost formulas – first-in, first-out (FIFO) or weighted-average cost – may be used.

Consignment inventory accounting journal entries

Imagine that Susan, a jewelry designer, decides to consign a selection of her handcrafted necklaces to “Glamour Boutique,” a local fashion store. Susan (the consignor) and Glamour Boutique (the consignee) sign a consignment agreement that includes a 30% commission for the consignee on each necklace sold. Consignment inventory can be beneficial to both consigners and consignees for several reasons. But it’s also important to be aware of the possible downsides of selling this way. Here’s a quick list of pros and cons to help you decide whether to give consignment a shot or stick to more traditional methods.

- However, it also introduces complexities in accounting, revenue recognition, and risk management.

- Consignment occurs when goods are sent by their owner (the consignor) to an agent (the consignee), who undertakes to sell the goods.

- The consignor retains legal ownership of the inventory throughout the consignment period, even though the goods may be in the consignee’s possession for display or sale.

- In other words, inventory that is initially sent out to the consignee is only recorded as a sale, once the consignee sells the inventory.

- In the consignment process, goods are left with a third-party by a manufacturer or provider.

Inventory transfer to consignee journal entry

Businesses dealing with bulky items or rapid obsolescence cycles find this particularly advantageous. Items sold on consignment are often 25–40% more expensive than when new. The consignee’s profit is made up of this extra margin; without it, the consignee wouldn’t be motivated to sell the items. Making wise business judgements is more straightforward with accurate data. To make your business function more smoothly, we assist you with demand predictions, reorder points and more. For example, you can view SKU performance over time and determine the days’ worth of inventory you have on hand in real-time from the Inventory LogIQ dashboard.

Consignor Records the Consignment Sales and Expenses

It’s also a way to test your products to see what sells well in person and what doesn’t. For instance, a supplier of Christmas decorations might agree with a large retail store to offer its products from October to December. The store doesn’t pay for the decorations in advance; payment only happens when customers buy the products during that period. The cost of goods sold for consigned inventory is recorded as the consignee’s purchase price plus any added costs, such as transportation or storage fees. This amount is deducted from the sales revenue to determine the gross profit earned on the sale.

When the consignee eventually sells the consigned goods, it pays the consignor a prearranged sale amount. The consignor records this prearranged amount with a debit california earned income tax credit and young child tax credit to cash and a credit to sales. It also purges the related amount of inventory from its records with a debit to cost of goods sold and a credit to inventory.

However, the consignor retains ownership of the item until it is sold to the end customer. Consigned inventory can lead to significant cost savings for businesses. By adopting consignment arrangements, companies can minimize their overhead costs by reducing the stock they must keep on hand. Consigned inventory refers to goods sent by their owner (consignor) to another party (consignee), who holds the goods and sells them on behalf of the owner.

These costs should be debited to the Inventory on Consignment account, not freight expense. Consignment inventory is the way that consignor allows the consignee to sell the inventory without paying for it. The consignee will require to pay the consignor only when the goods are sold. The goods belong to the consignor who will take full responsibility for any damage. Under IAS 2, inventory may include intangible assets that are produced for resale – e.g. software.